Revolis Alpha EURUSD M5

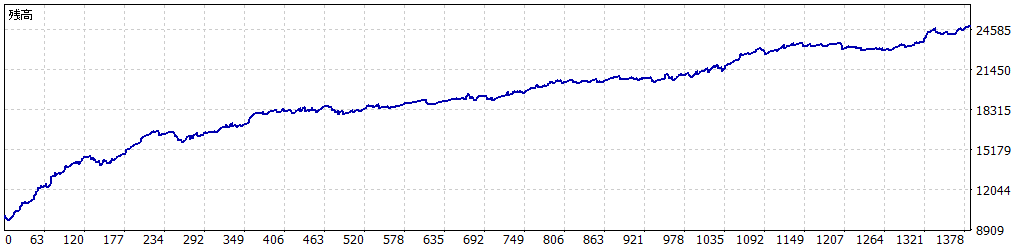

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

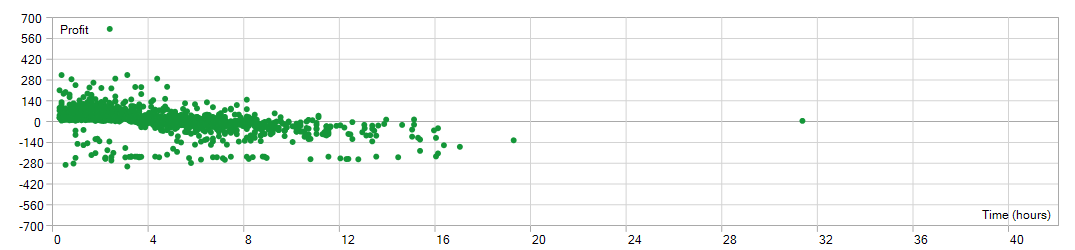

Forward testing (Profit)

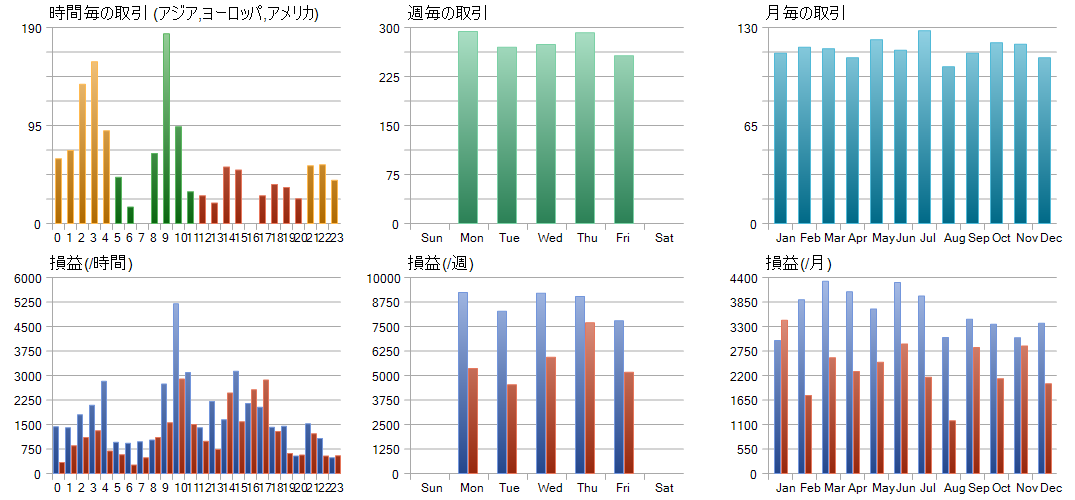

Monthly Statistics

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

Calendar for Months

About EA's Strategy

Translating...

Revolis Alpha

このEA名は造語で、「Revolution(革命)」+「Analysis(分析)」からの発想です。

Revolis Alpha については、勝率を重視したバージョンになります。

Revolis Sigma も同時に販売しようと思ってまして、こちらSigmaは、リカバリーファクターを重視した設計になります。

過去10年(2015年~2025年10月)のバックテストで、成績の違いは下記になります。

Alpha (勝率 67.95% RF 13.48%)

Sigma(勝率 52.13% RF 19.94%)

)

※2つのバージョンを販売しようと思ったのは、私自身が運用するに当たって、どちらも運用してみたいと思ったからです。

Alphaの設計意図として、

※ 「負けない」こと最優先に設計

・利益よりも「勝率」を主役に!!

・☓「爆益」 〇「負けにくい・続けられる」

このような方

・ EAで連敗して心が折れた

・利益よりも「安定」を求める人

| 通貨ペア | EURUSD (Euro vs US Dollar) | ||||

| 期間 | 5分足(M5) 2015.01.05 00:00 - 2025.10.30 23:55 (2015.01.05 - 2025.10.31) | ||||

| モデル | 全ティック (利用可能な最小時間枠による最も正確な方法) | ||||

| パラメーター | MagicNumber=1348; Lots=0.39; MaxSpread=3; TrailingStopStartPips=10; TrailingStopPips=110; Slippage=3; GMT=2; _summertime=""; Summertime=1; | ||||

| テストバー数 | 807776 | モデルティック数 | 239793277 | モデリング品質 | 90.00% |

| 不整合チャートエラー | 0 | ||||

| 初期証拠金 | 10000.00 | スプレッド | 15 | ||

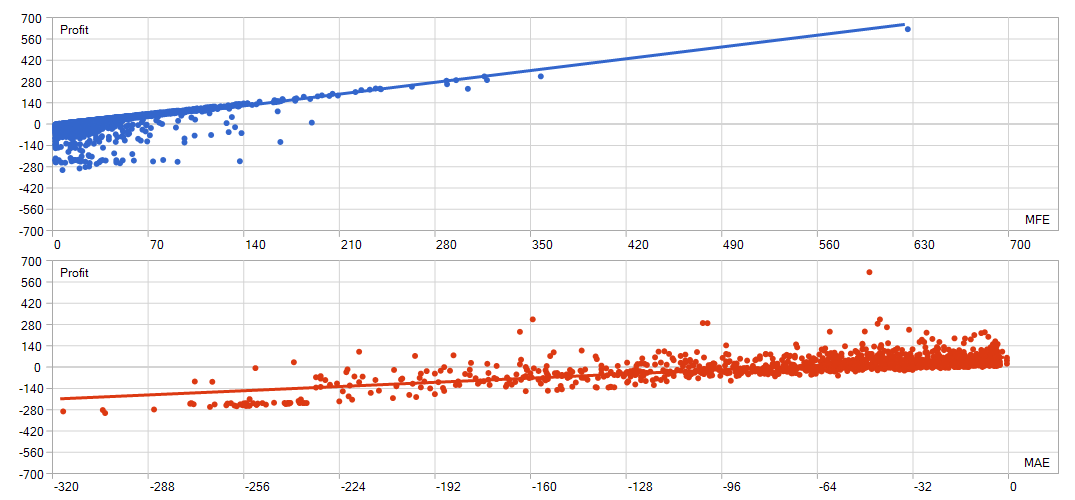

| 純益 | 13263.85 | 総利益 | 42501.60 | 総損失 | -29237.75 |

| プロフィットファクタ | 1.45 | 期待利得 | 9.49 | ||

| 絶対ドローダウン | 407.74 | 最大ドローダウン | 984.11 (6.08%) | 相対ドローダウン | 6.08% (984.11) |

| 総取引数 | 1398 | 売りポジション(勝率%) | 333 (68.17%) | 買いポジション(勝率%) | 1065 (67.89%) |

| 勝率(%) | 950 (67.95%) | 負率 (%) | 448 (32.05%) | ||

| 最大 | 勝トレード | 389.73 | 敗トレード | -303.03 | |

| 平均 | 勝トレード | 44.74 | 敗トレード | -65.26 | |

| 最大 | 連勝(金額) | 18 (806.00) | 連敗(金額) | 6(-406.18) | |

| 最大 | 連勝(トレード数) | 905.58 (15) | 連敗(トレード数) | -455.75 (3) | |

| 平均 | 連勝 | 3 | 連敗 | 2 | |

バックテスト概要

押し目・戻り目を確認して、大きな時間軸でトレンド方向にエントリー

高勝率時間帯のみ稼働

無理なナンピンなし

含み損を抱えにくい設計

「負けないことが、最大の勝ち」

「爆益より、生き残るEA」

「勝率は“安心感」

「コツコツ型が、最後に勝つ」

◎安心・継続・負けにくさ を最優先に考えた設計になります。

【パラメーターについて】

・マジックナンバー:他のEAと被らない番号を設定してください。

・Lots:ロットサイズを設定。運用スタイルにあわせて設定して下さい。

・最大許容スプレッド(Pips):エントリーを見送るスプレッド。小さくすることで取り引き回数は増えますが、成績が下がることが予想されます。

・トレーディンストップスタートPips:自由に変更できますが、過去10年間の相場で最適な設定にしてあります。

・トレーディンストップストップPips:自由に変更できますが、過去10年間の相場で最適な設定にしてあります。

・GMT ・・・冬時間のGMT値を入力してください

Summertime ・・・米国式なら1 英国式なら2 サマータイムなしなら0を入力

以下MT5でのバックテスト結果になります。

ストラテジーテスターレポート | ||||||||||||

設定 | ||||||||||||

| エキスパート: | Revolis Alpha EURUSD_M5 GG | |||||||||||

| 銘柄: | EURUSD-import | |||||||||||

| 期間: | M5 (2015.01.01 - 2025.10.31) | |||||||||||

| パラメータ: | MagicNumber=1348 | |||||||||||

| Lots=0.39 | ||||||||||||

| MaxSpread=3.0 | ||||||||||||

| TrailingStopStartPips=10 | ||||||||||||

| TrailingStopPips=110 | ||||||||||||

| GMT=2 | ||||||||||||

| _summertime=1で米国式、2で英国式、0でサマータイム無し | ||||||||||||

| Summertime=1 | ||||||||||||

| 会社: | 〇〇〇〇〇 FX Limited | |||||||||||

| 通貨: | USD | |||||||||||

| 初期証拠金: | 10 000.00 | |||||||||||

| レバレッジ: | 1:100 | |||||||||||

結果 | ||||||||||||

| ヒストリー品質: | 97% | |||||||||||

| バー: | 807487 | ティック: | 309912945 | 銘柄: | 1 | |||||||

| 総損益: | 14 874.04 | 残高絶対ドローダウン: | 327.68 | 証拠金絶対ドローダウン: | 400.22 | |||||||

| 総利益: | 43 568.86 | 残高最大ドローダウン: | 901.23 (5.41%) | 証拠金最大ドローダウン: | 959.16 (5.75%) | |||||||

| 総損失: | -28 694.82 | 残高相対ドローダウン: | 5.41% (901.23) | 証拠金相対ドローダウン: | 5.75% (959.16) | |||||||

| プロフィットファクター: | 1.52 | 期待利得: | 10.72 | 証拠金維持率: | 2119.17% | |||||||

| リカバリファクター: | 15.51 | シャープレシオ: | 4.94 | Z-Score: | -1.66 (90.31%) | |||||||

| AHPR: | 1.0007 (0.07%) | LR Correlation: | 0.97 | OnTester 結果: | 0 | |||||||

| GHPR: | 1.0007 (0.07%) | LR Standard Error: | 875.27 | |||||||||

| 取引数: | 1387 | ショート (勝率 %): | 333 (68.77%) | ロング (勝率 %): | 1054 (68.60%) | |||||||

| 約定数: | 2774 | 勝ちトレード (勝率 %): | 952 (68.64%) | 負けトレード (負率 %): | 435 (31.36%) | |||||||

| 最大 勝ちトレード: | 624.62 | 最大 負けトレード: | -301.86 | |||||||||

| 平均 勝ちトレード: | 45.77 | 平均 負けトレード: | -65.97 | |||||||||

| 最大 連勝数 (金額): | 18 (826.89) | 最大 連敗数 (金額): | 6 (-398.66) | |||||||||

| 最大 連勝利益額 (数): | 949.57 (7) | 最大 連敗損失額 (数): | -453.02 (3) | |||||||||

| 平均 連勝利益額 (数): | 3 | 平均 連敗数: | 2 | |||||||||

本商品は、将来の利益や運用成果を保証するものではありません。

相場状況やサーバー環境、スプレッド、約定状況等により、バックテストやフォワード結果と異なる成績となる場合があります。

本EAは自動売買プログラムであり、運用中に損失やドローダウンが発生する可能性があります。

最大ドローダウンやリカバリーファクター等の数値は、過去データに基づくバックテスト結果であり、将来の結果を保証するものではありません。

投資判断および運用の最終決定は、ご購入者様ご自身の責任において行ってください。

本商品を使用したことによるいかなる損失についても、制作者は一切の責任を負いかねます。

投資判断および運用の最終決定は、ご購入者様ご自身の責任において行ってください。

本商品を使用したことによるいかなる損失についても、制作者は一切の責任を負いかねます。

最後までご覧いただき有難うございました。

Price:¥36,000 (taxed)

●Payment

Sales from : 01/01/2026 18:21

Price:¥36,000 (taxed)

●Payment

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

→ Items to Check When EA is Not Operating

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working