NLAuto_USDJPY_Ver1.2

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Forward testing (Profit)

Monthly Statistics

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

Calendar for Months

About EA's Strategy

Translating...

NLAuto_Gaitame_USDJPY_Ver1.2|ニュース耐性×時間圧縮で“守りながら増やす”USDJPY専用EA

最大の特長は、重要指標の前後を自動で避ける“ニュースロック”と、時間経過に応じてSL/TP幅を段階的に縮める“時間圧縮リスク管理”。

急変動の被弾を抑えつつ、ATR×倍率の合理的な利確/損切り、BE(建値保全)+トレーリングで利益を残します。エントリーは短期/長期MA×RSIの整合で精度を高め、リスク%に応じた自動ロットまたは固定ロットを選択可能。**両建て(ブローカー許容時)**にも対応し、スキャル〜デイトレで機動的に稼働します。

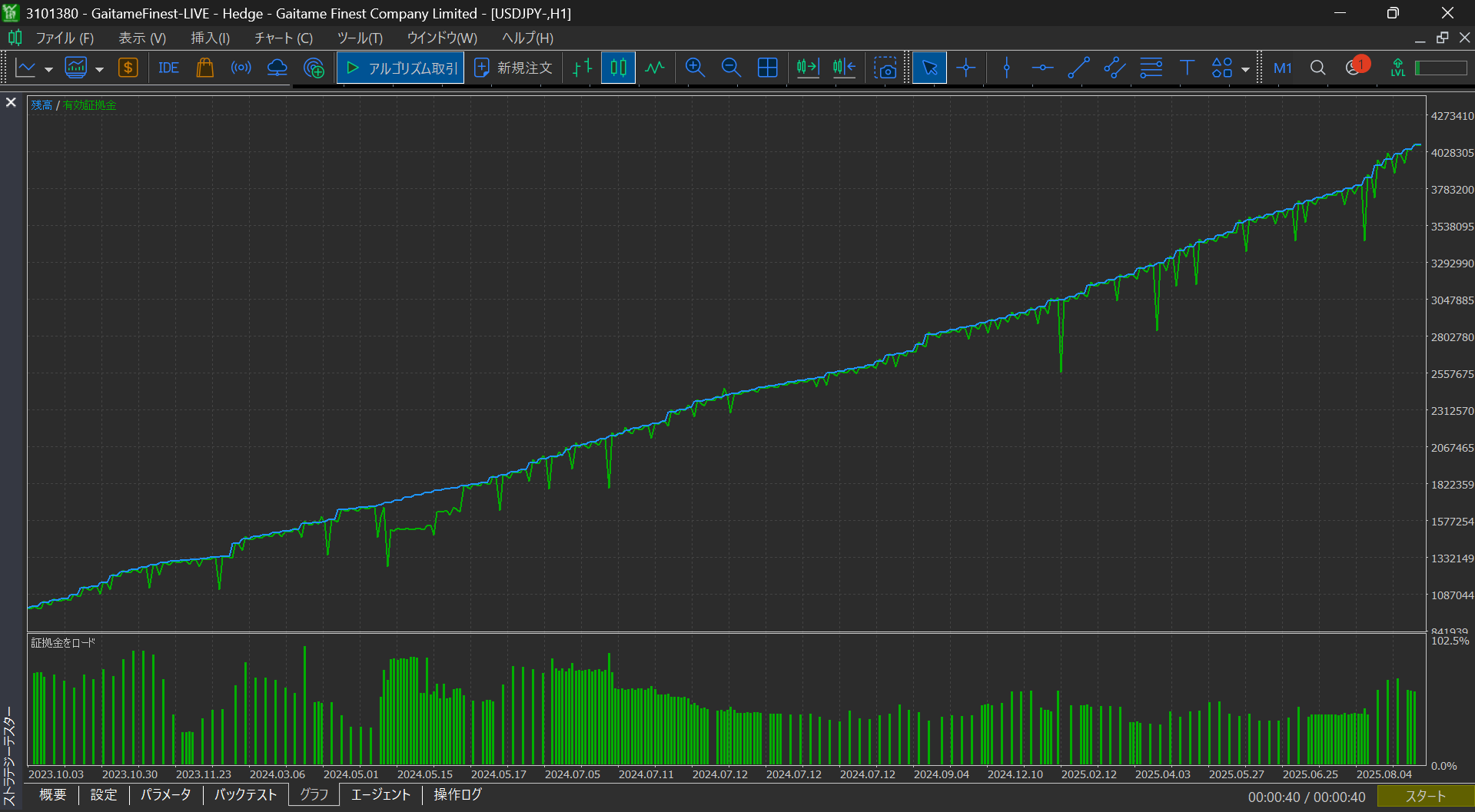

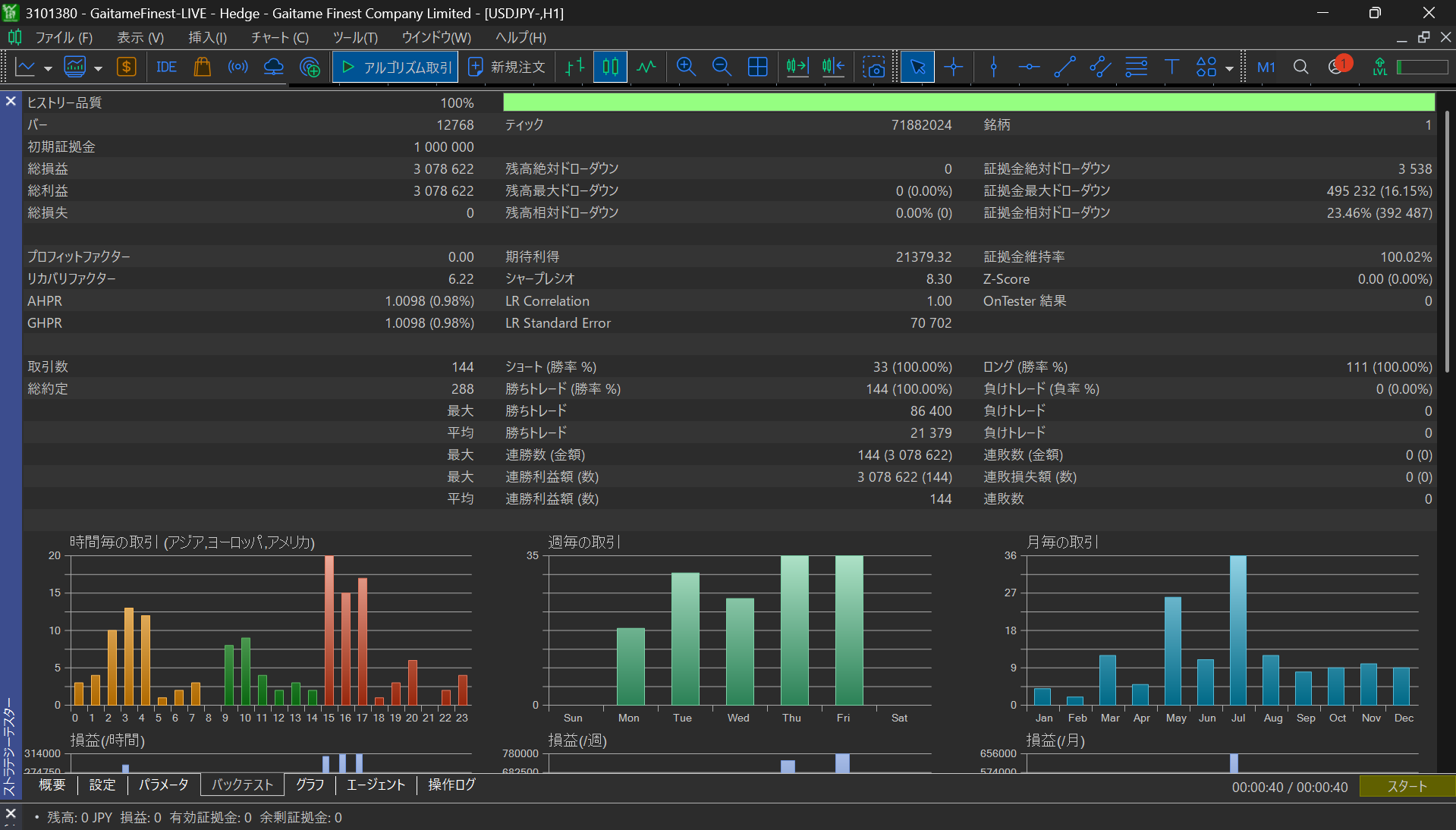

外為ファイネストMT5によるヒストリー品質1*0%での2年間のバックテスト結果

上図は2023年9月1日~2025年9月21日までのヒストリー品質1*0%外為ファイネストMT5を使用したバックテスト結果

EA名:NLAuto_Gaitame_USDJPY_Ver1.2

初期証拠金:100万円

PF:0.00(2年間で144戦144勝0敗)

RF:6.22

DD:16.15%

ロジック概要

-

トレンド×モメンタム合成:短期MAと長期MAの優位性+RSI閾値で、過剰逆張り/順張りの偏りを抑制。

-

出口の合理化:

ATR×倍率でSL/TPを初期設定→時間経過ごとに幅を×Rate%で段階縮小し、長期保有の含み損拡大や利確遅れを抑えます。 -

利益保全:一定の含み益でBE発動、以後はトレーリングで引き上げ。

-

追加エントリー(任意):SLまでの残距離が指定%以下で倍率ロットを追加し、優位局面を圧縮攻め。

-

ニュースロック:指定の重要度(★/★★/★★★)と発表前後◯分を自動回避。必要なら発表時間内の保有を自動クローズ。

主なパラメータ(既定値と推奨目安)

-

ATRMultiplier=61:SL/TP 幅=ATR×倍率(相場ボラに追従)

-

Fast/Slow MA=84 / 960, RSI=69, Overbought/Oversold=67/35, TimeFrame=M30

-

RiskPercentage=10%:口座残高×リスク%で自動ロット(固定ロットへ切替可)

-

BE:ブレイクイーブン

Activation=81pips / Confirm=100pips -

トレーリング:

95pips(利益伸ばし) -

時間圧縮:

Interval=1740分(約29時間),Rate=80%(各ステップでSL/TP幅を×0.8で縮小する新機能搭載) -

ニュース:

重要度=★★★,前後=60/60分, 時間内クローズ=ON(重要指標のデフォルトで60分前に新規エントリー禁止・その際にポジションがある場合は強制決済・指標後60分後から新規エントリー許可) -

追加エントリー:(任意)

SlRatio%到達でLot×倍率を追加

使いどころ

-

雇用統計や要人発言の“地雷”を踏みたくないUSDJPYトレーダー

-

保守的にリスクを抑えつつ、勝ちを積み上げたいスキャル〜デイトレ運用

-

指標前後の停止/クローズまで自動化して、放置運用の安定度を高めたい方

アピールポイント

-

ニュース耐性で大負けの芽を事前に遮断

-

時間圧縮+BE/TSで**“含み益を利益へ”を機械的に実行**

-

自動ロットで資金量に合わせた一貫リスク管理

-

両建て対応(ブローカー仕様に準拠)・最適化/バックテスト容易

※本EAは将来の利益を保証するものではありません。市場状況に応じたパラメータ最適化と適切なリスク設定を推奨します。

なぜニュースは危険か(市場マイクロ構造)

-

流動性が一瞬で薄くなる:板がスカスカ→スプレッド拡大・気配の飛びが発生。

-

価格の“飛び”:ティックが抜けるギャップで、逆指値やSLが想定外価格で約定(滑る)。

-

アルゴの初動:高速アルゴが一気に取りに来る→フェイクブレイクや往復ビンタになりやすい。

具体的な被害パターン

-

スプレッド拡大 例:USDJPYが平常0.2–0.4p → 指標前後で2–10p以上。成行/逆指値は即コスト増。

-

スリッページ(逆指値・SLの悪化約定) 1ロット(100k)USDJPYで10p滑る=約1万円の余計な損失。

-

ギャップ約定 価格が飛んで指値・逆指値が“飛び越え”、希望価格で約定しない。

-

リクオート/約定拒否 最大許容スリッページを超えて注文エラー→入り直し時はさらに不利。

-

強制ロスカット誘発 急変で評価損が急拡大、証拠金維持率が急低下。

-

誤作動/過剰約定 高波形のヒゲで連続約定→すぐ反転して損切りの連鎖。

-

相関崩れ 普段の逆相関/正相関が壊れ、ヘッジが効かない。

-

ブローカー仕様変更 「ニュース前はClose Only」「ストップレベル拡大」「証拠金率一時引上げ」等の一時ルールで戦略が崩れる。

よくある勘違い

-

「指標は大きく動く=儲かる」→方向とタイミングを外すと即死。

-

「SLがあるから大丈夫」→**ギャップでSLが“通過”**し、想定より大きく負ける。

-

「スキャルなら逃げ切れる」→約定遅延+広スプレッドでエッジが消える。

実務対策(裁量・EA共通)

-

取引停止ウィンドウ:重要度(★/★★/★★★)に応じて発表前後に停止(例:前60分/後60分)。

-

保有整理:発表跨ぎは建玉を軽く、もしくは全クローズ。(デフォルト全決済)

-

リスク%縮小:指標日はロット半減や最大損失上限を下げる。

-

逆指値の質:成行SL前提で、滑りコストも損益計算に織り込み。

-

ボラ連動:ATR連動SL/TP、トレーリングで過度な引っ張りを抑制。

-

カレンダー整合:タイムゾーン/夏時間ズレに注意(サーバー時刻基準で管理)。

-

ブローカー告知:指標日前の一時的ルール変更(証拠金率・最大数量等)を都度確認。

-

インフラ:低遅延VPS・安定回線で約定遅延や切断リスクを低減。

NLAuto_Gaitame_USDJPY_Ver1.2で落とし穴完全回避!

-

経済指標フィルター:

EconomicFilter=true、重要度はEconomic3(★★★)以上、EfStartTime/EfEndTimeを60–90分に調整。(デフォルト60分) -

時間圧縮:

RiskReductionInterval=1740、RiskReductionRate=80で長時間保有のリスク縮小。 -

BE/TS:

EnableBreakEven/EnableTrailingStop=trueで含み益の利益化を自動化。 -

追加エントリー:

AddEntryはニュース週はOFF推奨。(デフォルトOFF)

経済ニュースは**「方向」よりも「約定品質リスク」が致命傷になりやすいイベントです。

事前の停止・縮小・撤退ルールをシステムに組み込むことで、“踏まない・伸ばす・早く畳む”を自動で徹底でき、ドローダウンの頻度と深さ**を同時に抑えられます。

MT4で経済ニュース回避が困難だった理由

MT5は「公式の経済カレンダーAPI(Calendar系関数)」が標準搭載、MT4は“公式APIが無い”ため外部依存になり、実装も保守も難しかった──これが差の本質です。

何が違うのか?

MT5(容易)

公式API:

CalendarValueHistory / CalendarEventById / CalendarCountriesなどで重要度・通貨・時刻を直接取得時刻整合:サーバー時刻とDSTを端末側で整合済み

絞り込み:重要度(★/★★/★★★)、前後◯分などをコードで即フィルタ

保守性:データ源が公式・一貫フォーマットなので壊れにくい

MT4でニュース回避が難しい理由

公式APIなし:WebRequest+外部サイトや独自CSV/インジに依存

設定依存:

WebRequestには許可URLの手動登録が必要、環境で失敗しがち形式バラバラ:サイトごとにJSON/HTML/CSVの仕様違い→パーサー実装・破損対応が必要

時刻ズレ:サーバー時刻・ローカル・UTC・DSTの補正を自前実装

信頼性:サイト側のレート制限・変更・停止で即死、保守コスト大

実務インパクト

実装時間:MT5は数十行で完結、MT4は取得・解析・タイムゾーン補正まで必要

安定性:MT5は壊れにくい/MT4は外部変更で壊れやすい

再現性:MT5はバックテスト/運用で同じ判定を再現しやすい

補足:MT4でやるなら

重要イベントの手動カレンダー停止(EA側フラグ)

外部インジ・スクリプト連携時はURL許可・DST補正・例外処理を厳格に

代替としてボラ指標(ATR等)での自動停止も併用

要するに、MT5は“公式データに直接つながる設計”だから簡単かつ堅牢、MT4は“外部を寄せ集める必要”があり脆い、ということです。

The coupon will expire in 3 days.

Price:¥39,800 (taxed)

●Payment

The coupon will expire in 3 days.

Sales from : 10/06/2025 01:14

Price:¥39,800 (taxed)

●Payment

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

→ Items to Check When EA is Not Operating

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working