爆勝ちAUD/CAD

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Profit

:

253,499JPYProfit Factor

:

2.79Rate of return risk

?

:

0.53Average Profit

:

1,695JPYAverage Loss

:

-2,427JPYBalance

?

:

1,253,499JPYRate of return (all periods)?

:

23.38%Win Rate

:

80.00%

(240/300)

Maximum Position

?

:

6Maximum Drawdown

?

:

43.89%

(482,352JPY)

Maximum Profit

:

131,779JPYMaximum Loss

:

-13,211JPYRecommended Margin

?

:

1,084,100JPYUnrealized P/L

:

-2,831JPYDeposit

?

:

1,000,000JPYCurrency

:

JPY- Account

Operable Brokers

Usable with MT4-adopting brokers.

Forward testing (Profit)

Product Statistics

Product Comments

Monthly Statistics

2025

2024

2023

2022

2021

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

Calendar for Months

About EA's Strategy

Translating...

Currency Pairs

[AUD/CAD]

Trading Style

[Day Trading]

[Swing Trading]

Maximum Number Position

12

Maximum Lot

1.28

Chart Time Frame

M15

Maximum Stop Loss

0

Take Profit

15

Straddle Trading

Yes

Application Type

Metatrader Auto Trading

Other File Usages

No

EAは基本的に2種類に分かれます

単ポジEAとナンピンEAです

それで失敗した話をよく聞きます

そういう人たちはこぞってこう言います!

「ナンピンEAはクソだ!」

ただそういうマインドの人が

ただそれだけの理由で

だからナンピンしない単ポジEAを使いたい!

という事で単ポジEAを使うと

ナンピンEAでの失敗とは違う形で失敗します!

ナンピンせずに損切りを入れて

勝ったり負けたりを繰り返して

トータルで勝ちを目指す単ポジEAは

実際に使ってみると分かりますが

負けが続く期間が結構長かったりして

2年後とかにはトータルプラスになるとしても

目先の数日や数週間はもちろん

半年くらいトータルマイナスだったりもします

実際、このゴゴジャンには

たくさんの単ポジEAが販売されてますが

レビューを見ると

やはり目先のマイナスに対する不満が書かれているのが見受けられます

要はあなたが求めてるのは

何ヵ月もマイナスが続くが

1年後や2年後とかにやっとトータルプラスになるようなEAではなく

常にプラスじゃないとダメなわけですよね?

そもそも常にプラスじゃないとダメなら

ナンピンEAを使うしかないわけです

ただナンピンEAで強制ロスカットになった

苦い経験のあるあなたの理想は

単ポジで短期間でも常にプラスのEAを使いたい

という事でしょうけど

でもそれは物理的に無いんです!

単ポジEAで半年などの長期間のマイナスも耐えて

1年2年くらい我慢してやっとプラスか

資金が飛ぶまでは常にプラスだが

強いトレンドが出たら

一発で強制ロスカットの可能性があるナンピンEAか

そもそもEAはどちらかしか存在しないんですね!

ただ、あなたが満足出来るEAは

やはり常にプラスは必須ですよね?

なら物理的にナンピンEAじゃないと無理です

でもナンピンEAは一発で強制ロスカットになるじゃないか!怒

と言いたいでしょうけど

じゃあ絶対に強制ロスカットにならないは無理でも

その可能性が相当低く

尚且つ月利もそれなりのナンピンEAがあったらどうでしょうか?

まさに今回提供するEAが

そういうEAです

膨大な検証の結果それを実現出来たのがこのEAなんですね!

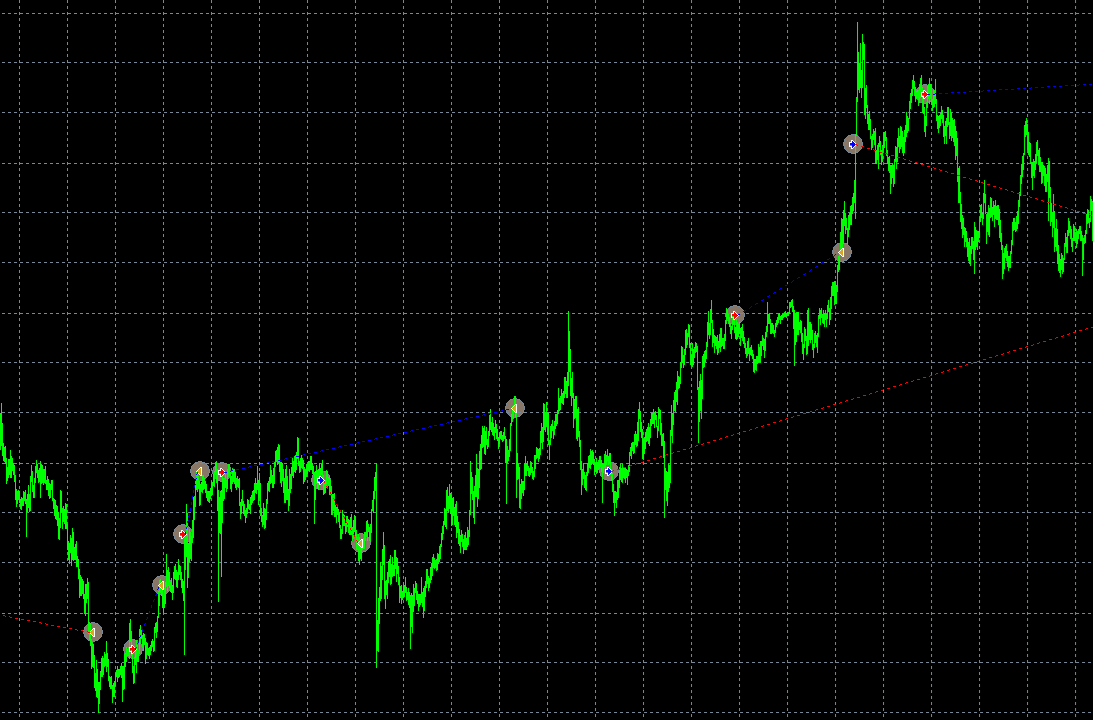

まずポジションを取る条件に移動平均線でのマルチタイムフレームのロジック

要は上位足のトレンドに沿ってポジションを取るロジックがあり

完全順張りでポジションを取ります

そのトレンドに沿ってプラスアルファCCIの独自ロジックまで条件が揃ったらエントリーします

更に考えうる全てのナンピン幅を検証して一番良かったパターンを採用してます

ナンピンEAなので常にプラスを保ち

その上で月利もそれなりに高い

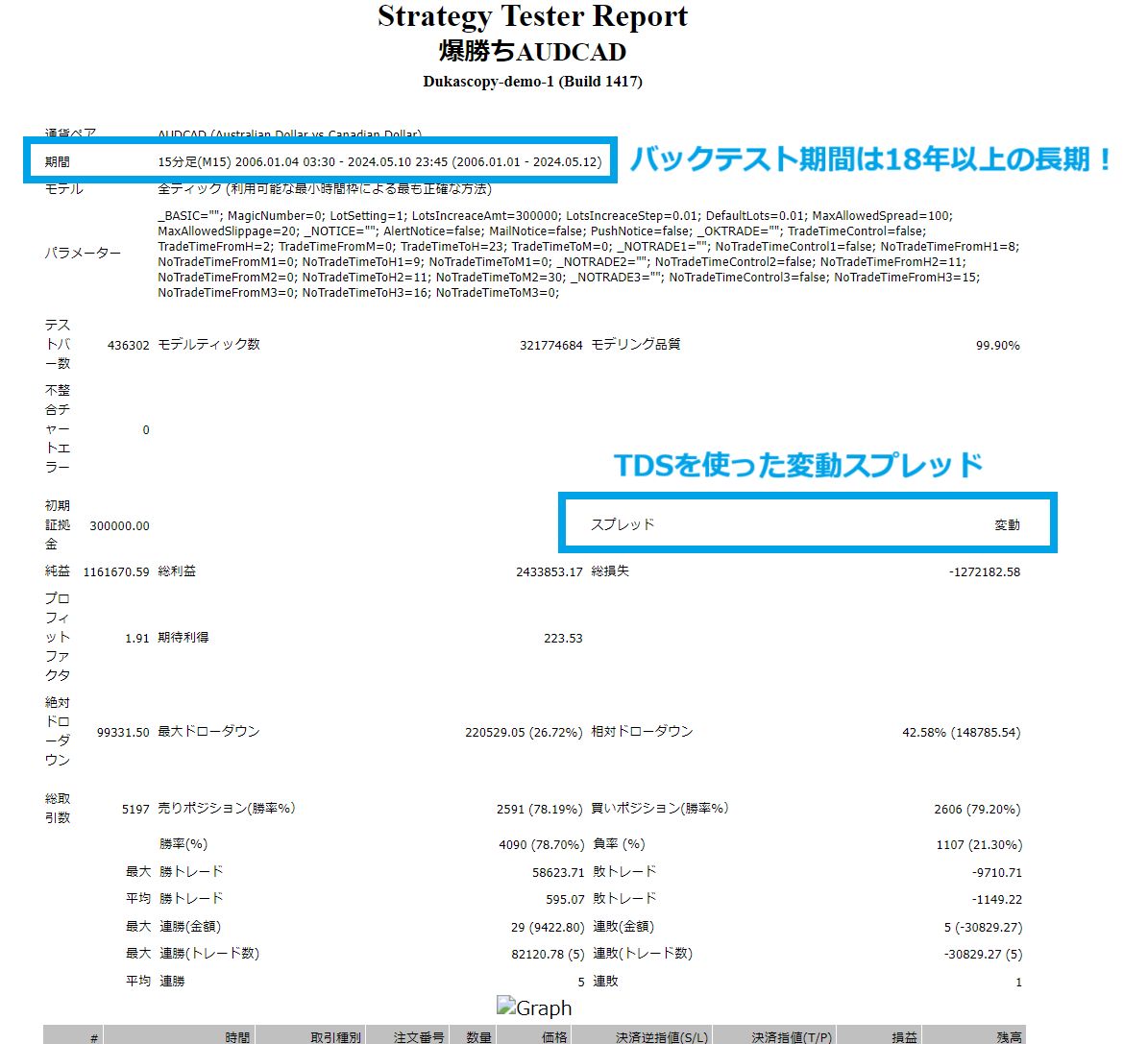

以下のバックテストを見てもらえば分かると思いますが

かなり安心して安全に使用出来き

尚且つ月利もいい感じのEAです

なのでEA名はただカッコいいだけの名前ではなく

爆勝ちAUD/CAD

というこのEAの特徴が分かりやすい名前にしました!

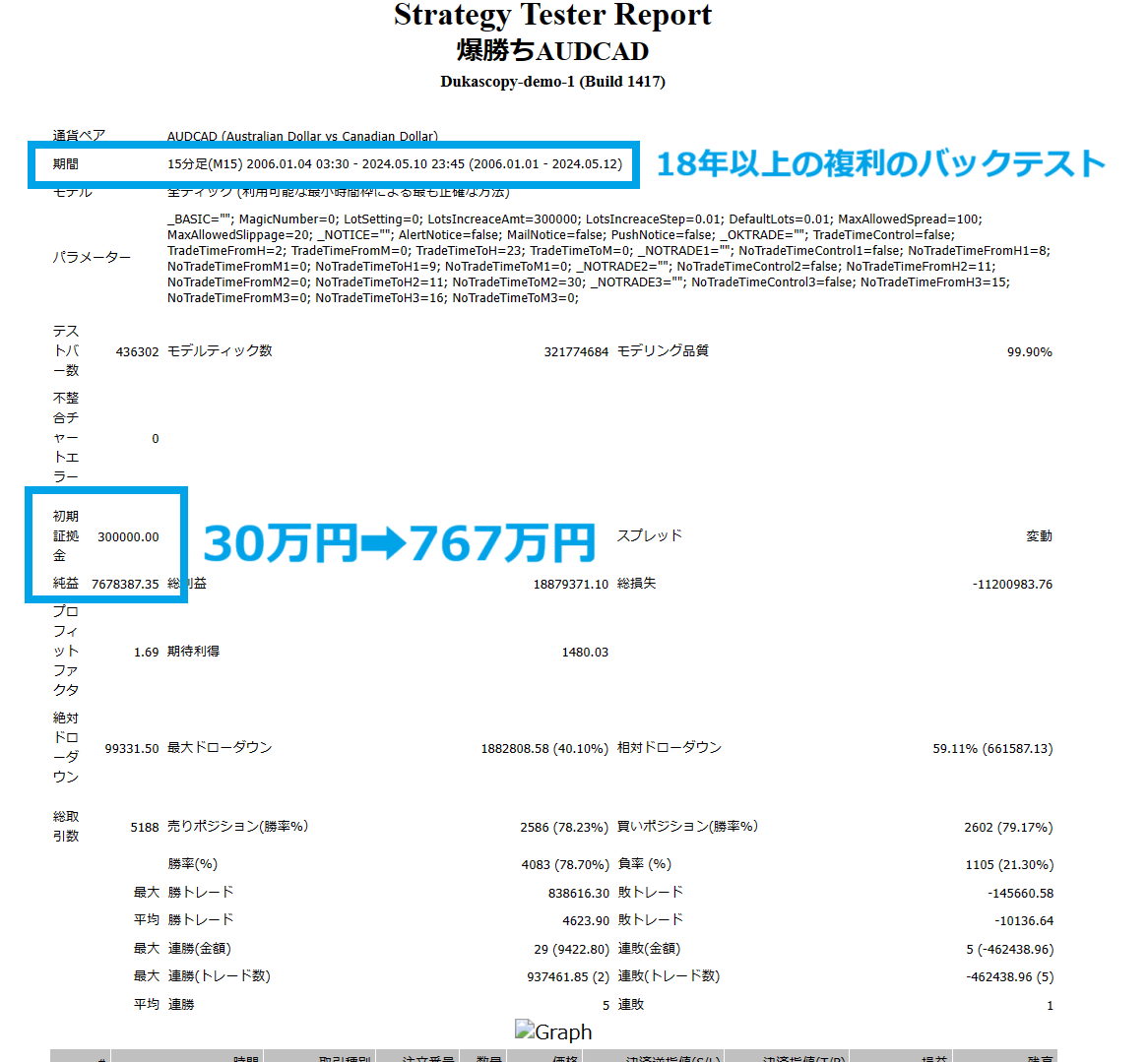

約18年間のバックテストで

元手以下の最大ドローダウンになってます

◆単利運用のバックテスト

(TSD変動スプレッド 2.2pips~4.2pips レバレッジ25倍

スワップ 買いスワップー20 売りスワップ―20)

■18年以上の長期のバックテストで最大ドローダウンは初期証拠金以下です

※初期証拠金300000円 最大ドローダウン220529.05円

2024年8月の歴史的な荒れ相場でもゴゴジャンでのフォワードの

最大ドローダウンは0.03ロットで482352円

0.01ロットなら482352円÷3=最大ドローダウン160784円

他のナンピンEAは強制ロスカットになりまくっている相場で

この程度のドローダウンで済んでます

■プロフィットファクターも1.91と高めです

■ワンショット型(単ポジEA)と違って資産曲線は常に右肩上がりです

◆複利運用のバックテスト

(TSD変動スプレッド 2.2pips~4.2pips レバレッジ25倍

スワップ 買いスワップー20 売りスワップ―20)

■30万円につき0.01ロットの複利運用

※60万円まで増えたら0.02ロット90万円まで増えたら0.03ロット

以降30万円増える度に0.01ロットずつロット数を増やしての複利運用

■最大ドローダウンが初期証拠金より多いのは複利運用でロットを増やしているため

18年以上を証拠金30万円につき30万円以下のドローダウンを保てている

例)証拠金が60万円に増えてからは以降60万円以下のドローダウン

証拠金90万円に増えてからは以降90万円以下のドローダウン

その後も更にプラス30万円になるごとにその時の証拠金以下のドローダウンで収まっている

2024年8月の歴史的な荒れ相場でもゴゴジャンでのフォワードの

最大ドローダウンは0.03ロットで482352円

0.01ロットなら482352円÷3=最大ドローダウン160784円

他のナンピンEAは強制ロスカットになりまくっている相場で

この程度のドローダウンで済んでます

■30万円が18年ちょっとで767万円なので平均月利は約11パーセントほど

複利で億単位に増えるなど謳っているEAと違い現実的な利益です

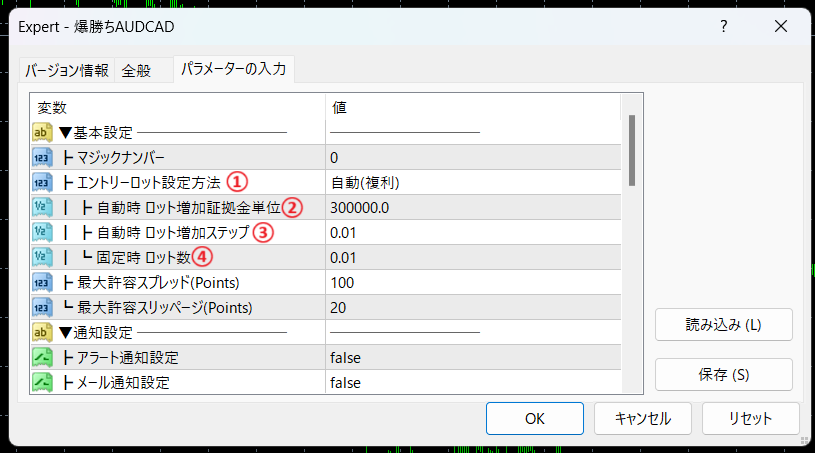

■パラメーターの説明

①複利運用するか単利運用するかを選択します

※ダブルクリックすると選択できるプルダウンです

②複利運用の場合いくら増える度にロットを増やすか?の

金額を入力する項目です

③複利運用の際に②で設定した金額が増える度にエントリーするロット数を

何ロット増やすかを入力する項目です

例)60万円増える度に0.02ロット増やしたいなら②を600000で③を0.02という感じです

上記の複利のバックテストはデフォルトの②が300000③が0.01です

④単利運用時のロット数です

よくある質問

Q1:どのFX会社でも使用出来ますか?

A1:はい!MT4があるところならどこでも使用出来ます

Q2:最低証拠金はいくらでしょうか?

A2:約18年間のバックテスト上では複利でレバレッジ25倍で25万円につき0.01ロットで行けてます

2024年8月の歴史的な荒れ相場でもゴゴジャンでのフォワードの

最大ドローダウンは0.03ロットで482352円

0.01ロットなら482352円÷3=最大ドローダウン160784円

他のナンピンEAは強制ロスカットになりまくっている相場で

この程度のドローダウンで済んでます

なので0.01ロットで25万円でやればあれだけの介入の荒れ相場も

危なげなく乗り越えてます

Q3:使用する通貨ペアと時間足は何ですか?

A3:動作自体は全通貨ペア1分足や5分足などでも稼働出来ますが

バックテストの通り通貨ペアはAUD/CADで時間足は15分足での使用を想定して作成してます

A4:常に放置での運用で大丈夫ですか?手動で止めたりは必要でしょうか?

Q4:基本的に完全放置での使用を想定してます

2024年8月の歴史的な荒れ相場でも放置で今の状態です。

Sales from

:

06/06/2024 21:58

Purchased: 0times

Price:¥25,000 (taxed)

About 1-Click Order

●Payment

Forward Test

Back Test

Sales from : 06/06/2024 21:58

Purchased: 0times

Price:¥25,000 (taxed)

About 1-Click Order

●Payment

About Forex Automated Trading

What is Forex Automated Trading (MT4 EA)?

Forex Automated Trading refers to trading that is automated through programming, incorporating predetermined trading and settlement rules. There are various methods to conduct automated trading, but at GogoJungle, we deal with Experts Advisors (hereinafter referred to as EA) that operate on a trading platform called MT4.

Trading Types of Forex Automated Trading

There are various types of EAs (Expert Advisors) for different trading types that can be used on MT4.

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Risks, Advantages, and Disadvantages of Forex Automated Trading

When engaging in Forex, there are risks in automated trading just as there are in discretionary trading.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

Equipment and Environment Needed for Automated Trading Operation

The requirements for operating automated trading (EA) on MT4 are as follows:

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Installation of MT4 and Account Login

If you open an account with a forex broker that supports MT4, you can use MT4 as provided by that forex broker. MT4 is a stand-alone type of software that needs to be installed on your computer, so you download the program file from the website of the FX company where you opened the account and install it on your computer.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

How to Install EA on MT4

To set up an EA when you purchase it through GogoJungle, follow the steps below:

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

In Case You Want to Change the Account in Use

EAs from GogoJungle can be used with one real account and one demo account per EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

Solutions for Errors During Web Authentication or Non-Functional Account Trading

If you encounter an error with Web authentication, or if the EA is trading on GogoJungle's forward performance page but not on your own account, there could be various reasons. For more details, please refer to the following link:

→ Items to Check When EA is Not Operating

→ Items to Check When EA is Not Operating

About the Size of Trading Lots

In Forex trading, the size of a lot is usually:

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

Glossary of Automated Trading

・Profit Factor: Total Profit ÷ Total Loss

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

Useful related pages

・How to Install MT4 EA (Expert Advisor) and Indicators

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working