rushEx-audcad

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Profit

:

454,368JPYProfit Factor

:

1.46Rate of return risk

?

:

0.97Average Profit

:

1,633JPYAverage Loss

:

-2,270JPYBalance

?

:

1,454,368JPYRate of return (all periods)?

:

36.32%Win Rate

:

67.00%

(952/1421)

Maximum Position

?

:

12Maximum Drawdown

?

:

30.82%

(466,628JPY)

Maximum Profit

:

40,351JPYMaximum Loss

:

-70,299JPYRecommended Margin

?

:

1,250,850JPYUnrealized P/L

:

-21,323JPYDeposit

?

:

1,000,000JPYCurrency

:

JPY- Account

Operable Brokers

Usable with MT4-adopting brokers.

Forward testing (Profit)

Product Statistics

Product Comments

Monthly Statistics

2026

2025

2024

2023

2022

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

Calendar for Months

About EA's Strategy

Translating...

Currency Pairs

[AUD/CAD]

Trading Style

[Day Trading]

[Swing Trading]

Maximum Number Position

20

Maximum Lot

100

Chart Time Frame

M5

Maximum Stop Loss

300

Take Profit

0

Straddle Trading

No

Application Type

Metatrader Auto Trading

Other File Usages

No

■■■[EAの概要]■■■

rushEx-audcadは、豪ドル/カナダドルの5分足に適用するナンピン・マーチンゲール型EAです。

一般的なナンピン・マーチンゲール型EAだと

10PIPSなどの固定のナンピン幅で機械的にロットを追加し、

その際のロット数も倍々に増やしていくのが主流です。

しかし、そんな単純なロジックだと、

勢いのある暴騰・暴落に巻き込まれてしまった場合、

早い段階で次々とナンピンされ、ロット数も大きく膨れ上がるために

破綻のリスクにさらされる確率が高まり、身動きも取れなくなってしまいます。

そのようなリスクを避けるために

rushEx-audcadでは固定のナンピン幅ではなく

流動的にナンピン幅を変動させる独自のロジックを採用しています。

このロジックにより無駄なナンピン打ちを減らし、

追加ロットの回数をできるだけ抑えるようになっています。

また、ナンピンする際は倍々にロット数を増やす幾何級数的な方法ではなく、

決まったロット数を加算するだけの算術級数的な方法を採用しているので

合計のロット数も膨大に膨れ上がることはありません。 ■■■[EAの特徴]■■■

・AUDCADの5分足専用のEA

・ナンピン、マーチンゲールを使用したEA

・変則的なナンピン、変則的なマーチンゲール

・ポジション毎にストップを設定

・簡単なパラメーター設定

これらの特徴を簡単に説明すると、

・AUDCADの5分足専用のEA

rushEx-audcadは、AUDCAD5分足専用のEAです。

それ以外の通貨ペア、時間足では稼働しないようになっています。

・ナンピン、マーチンゲールを使用したEA

本EAはナンピンとマーチンゲールを使用しています。

つまり、既定の含み損以上になると、追加でポジションを持ち(ナンピン)、

且つ、ポジションを追加するごとにロット数を増やしていきます(マーチンゲール)

そして、ポジション全体で規定以上の含み益になると

まとめて決済する仕様です。

しかし、単純なナンピン、マーチンゲールではなく、

変則的なナンピン、マーチンゲールを採用しています。

・変則的なナンピン、変則的なマーチンゲール

一般的には、"10PIPS逆行したらナンピンする"、といった、

固定PIPSでナンピンをするケースが多いですが、

本EAは変則的なナンピン仕様になっています。

具体的には、ローソク足の並びやインジケーターなどから判断し、

トレンドが続きそうなときにはナンピンせず、

トレンドが一段落ついたところでナンピンするようにしています。

こうすることで、無駄なナンピン打ちを減らすようにしました。

また、ロット数を倍々に増やすマーチンゲールではなく、

パラメーターで指定した単純加算でのロット増加にしています。

こうすることで、ナンピン後半にいくにつれて

急激にロット数が増加する危険性を減らしています。

具体的には、パラメーターの初期設定では、

0.02⇒0.05⇒0.08⇒0.11⇒0.14⇒、、、

というように、

最初0.02ロットから始まり、0.03ロットずつ加算されていく仕様です。

・ポジション毎にストップを設定

一般的なナンピン、マーチンゲールEAだと、

ストップを設定しないものも多いですが、

それだと一方的なトレンドに飲み込まれた場合、

含み損が膨大に膨れ上がり、強制決済させられる危険性が高まります。

そうした危険性を減らすために、

本EAでは全てのポジションにストップを設定しています。

よって、一方的なトレンドに飲み込まれたとしても、

その都度ストップにかかるので、大きな損失を抑えることができ、

無駄にポジションを長引かせません。

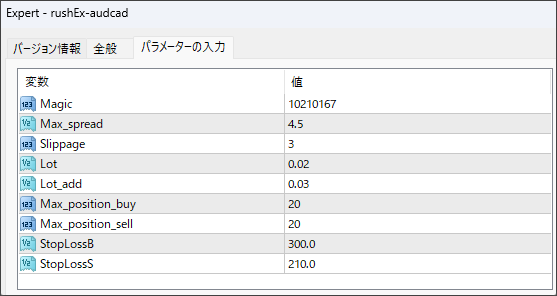

・簡単なパラメーター設定

本EAは初心者様にでも安心して使えるように

パラメーター項目はできるだけ少なくしています。

つまり、余計なパラメーターは内部変数化しているので、

パラメーター調整などの最適化作業は必要ありません。

一応念のため、ロット数やストップ幅をパラメーター化していますが、

特に変更する必要は無く、初期値のままで稼働できます。

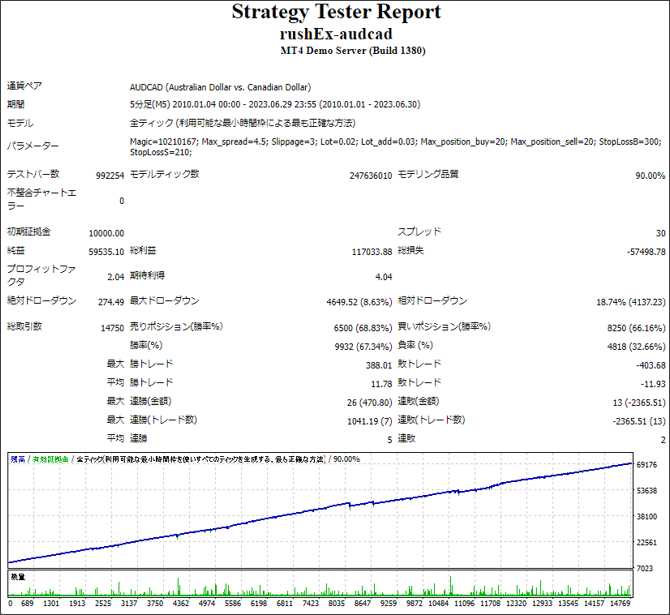

■■■バックテスト■■■

約14年6カ月の期間で14750回の取引回数がありますので、

1ヶ月だと平均85回ほどエントリーする計算になります。

また、一般的なナンピンEAだと収益グラフは定規で線を引いたような

綺麗な一直線の右肩上がりのラインになりますが、

本EAの場合、見た目には分かりづらいかもしれませんが、

多少上下に波を描きながらの右肩上がりの収益グラフになっています。

なぜこのような収益グラフになるのかというと、

先にも説明したように、ポジション毎にストップを設定しているからです。

つまり、適宜ストップにかかってるので、

その分だけ、収益グラフも上下に波打つことになります。

これは決して悪いことではなく、適宜ストップにかかるということは、

その分、含み損が膨れ上がる可能性が低くなることを意味します。

■■■フォワードテスト■■■

実は、本EAはゴゴジャンで販売を開始する前に、

別のFXサイトでフォワードテストを行っており、

その結果が以下のグラフになります。

2021年4月から2023年5月までの約2年間、

継続的にフォワードテストを行っていました。

2年間で2141回トレードを行って1422勝719敗の勝率66.42%、

PF(プロフィットファクター)は2.29で、

総合計で+11614PIPS獲得という成績を収めました。

勝率も、勝ち幅も、負け幅も、PFも、

バックテストとフォワードテストで似たような数値になっているので、

再現性が高いEAと言えるでしょう。

2021年4月から2023年5月までの約2年間、

継続的にフォワードテストを行っていました。

2年間で2141回トレードを行って1422勝719敗の勝率66.42%、

PF(プロフィットファクター)は2.29で、

総合計で+11614PIPS獲得という成績を収めました。

勝率も、勝ち幅も、負け幅も、PFも、

バックテストとフォワードテストで似たような数値になっているので、

再現性が高いEAと言えるでしょう。■■■パラメーター■■■

売りポジションでのストップ幅(PIPS)

*補足説明

初期値のままで運用した場合、

最初のロット数は0.02で、最初のナンピンでは0.03加算されて0.05ロットに、

次のナンピンでも0.03加算されて0.08ロット、というように増えていきます。

0.02⇒0.05⇒0.08⇒0.11⇒0.14、、、、、

総ポジション数が20の場合、

最初のエントリーを除いて、最大で19回ナンピンする可能性があります。

・適切なロット数について

バックテストとリアルトレードを見る限りにおいては

50万円の証拠金に対して0.02ロット(追加で0.03ロット)

つまり、パラメーター初期値での運用を基本とします。

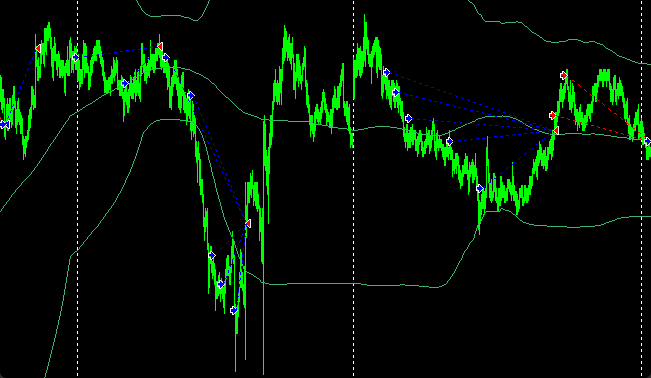

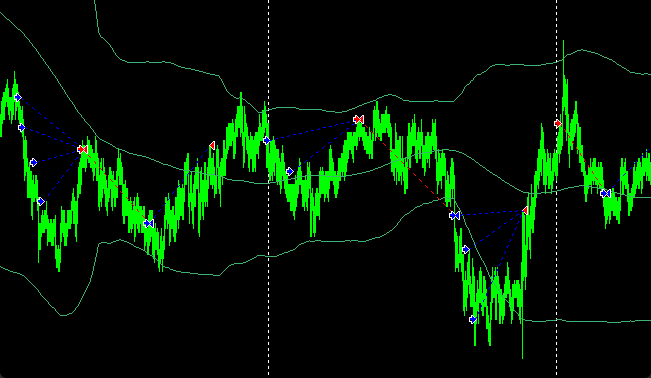

■■■エントリー状況■■■

(縦白ラインはNYクローズで、その間が一日です)

サンプル2

サンプル3

現在保有している全てのポジションを決済してから途転する形になります。

■■■よくある質問■■■

Q1:どこのブローカーでも稼働できますか?

A1:GMT+2(夏時間はGMT+3)のMT4を採用しているのであれば、

どこのFX会社でも稼働できます。

Q2:週末のポジション持越しはありますか?

A2:週末の決済機能はありませんので、大引け間際にポジションを取った場合は、翌週に持ち越すこともあります。

Q3:夏時間、冬時間の設定は必要ですか?

A3:必要ありません。

Q4:1つのMT4で他のEAと同時に稼働させることはできますか?

A4:同時に稼働させることはできます。

しかし、証拠金が少ない中で、本EAと他のEAが共に含み損を抱えていた場合、

保証金維持率を下回って強制決済される可能性はあります。

また、マジックナンバーは他のEAとは異なる数字を設定してください。

Q5:手動でポジションを決済することはできますか?

A5:できます。

しかし、複数ポジションを持っていて、その中の一部だけを決済すると、

その後、正常な動きをしない可能性も否定できないので、

手動で決済する場合は、全てのポジションをまとめて決済してください。

Q6:最大で20ポジション持つ可能性があるのですか?

仕様的には20ポジションまで持つことになっていますが、

実際にはそこまでポジションが増えるケースは極々稀です。

なぜなら、ポジション毎にストップを設定しているからです。

20ポジション持つ前に、最初のポジションからストップにかかり、

決済されるケースが大半です。

Q7:資金が増えた場合はどのようにロットを増やすのですか?

基本的には、[Lot]=0.02(初期値)、[Lot_add]=0.03(初期値)の割合を

維持したままでロット数を増やしていくことを推奨します。

例えば、資金が倍になったら、[Lot]=0.04、[Lot_add]=0.06へ、

3倍になったら[Lot]=0.06、[Lot_add]=0.09という具合です。

Q8:年末年始もエントリーしますか?

年末年始は12月16日~1月3日までの間は新規のエントリーは行われませんが、既にポジションを持っていた場合は追加のナンピンは行われます。

■■■免責事項■■■

・本EAの著作権は、著作権法で保護されている著作物に当たります。

・本EAの複製、改変、再配布などは法律により固く禁止されています。

・本EAの内容については、予告なく掲載を変更、中止することがあります。

・本EAのバックテスト、フォワードテストの結果は、

将来における確実な利益を保証するものではありません。

・本EAの利用により発生した損失については、

プログラムの不具合、バグなどの原因も含め、開発者は一切の責任を負いません。

必ず自己責任でお願いします。

Sales from

:

10/04/2023 21:37

Purchased: 4times

Price:¥24,000 (taxed)

About 1-Click Order

●Payment

Forward Test

Back Test

Sales from : 10/04/2023 21:37

Purchased: 4times

Price:¥24,000 (taxed)

About 1-Click Order

●Payment

About Forex Automated Trading

What is Forex Automated Trading (MT4 EA)?

Forex Automated Trading refers to trading that is automated through programming, incorporating predetermined trading and settlement rules. There are various methods to conduct automated trading, but at GogoJungle, we deal with Experts Advisors (hereinafter referred to as EA) that operate on a trading platform called MT4.

Trading Types of Forex Automated Trading

There are various types of EAs (Expert Advisors) for different trading types that can be used on MT4.

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Risks, Advantages, and Disadvantages of Forex Automated Trading

When engaging in Forex, there are risks in automated trading just as there are in discretionary trading.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

Equipment and Environment Needed for Automated Trading Operation

The requirements for operating automated trading (EA) on MT4 are as follows:

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Installation of MT4 and Account Login

If you open an account with a forex broker that supports MT4, you can use MT4 as provided by that forex broker. MT4 is a stand-alone type of software that needs to be installed on your computer, so you download the program file from the website of the FX company where you opened the account and install it on your computer.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

How to Install EA on MT4

To set up an EA when you purchase it through GogoJungle, follow the steps below:

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

In Case You Want to Change the Account in Use

EAs from GogoJungle can be used with one real account and one demo account per EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

Solutions for Errors During Web Authentication or Non-Functional Account Trading

If you encounter an error with Web authentication, or if the EA is trading on GogoJungle's forward performance page but not on your own account, there could be various reasons. For more details, please refer to the following link:

→ Items to Check When EA is Not Operating

→ Items to Check When EA is Not Operating

About the Size of Trading Lots

In Forex trading, the size of a lot is usually:

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

Glossary of Automated Trading

・Profit Factor: Total Profit ÷ Total Loss

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

Useful related pages

・How to Install MT4 EA (Expert Advisor) and Indicators

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working