100,000 yen loss

50,000 yen is expensive. But 100,000 yen can be wiped out

Summary (you only need to read this)

Many people skimp on 50,000 yen and lose 100,000 yen in the market

・The issue is not the amount,the misalignment of the decision criteria

・Losses are treated as “learning costs,” making them hard to recognize as actual payments

・鬼速AI is a tool to stop that chain of losses

・Losses are treated as “learning costs,” making them hard to recognize as actual payments

・鬼速AI is a tool to stop that chain of losses

People feel that 50,000 yen for an indicator is “high.”

Yet losses of 20,000–30,000 yen in the market are often dismissed as “can’t be helped.”

…Think about that calmlyisn’t it strange?

50,000 yen is expensive.

But 100,000 yen can be melted away.

But 100,000 yen can be melted away.

Why does this happen? (Psychology)

This isn’t because your will is weak.

There is a mental framework in which the human brain tends to make such judgments.

・Tool cost isa visible expense(the moment you pay is painful)

・Loss isan invisible payment

・Therefore, losses are treated lightly and repeated

・Loss isan invisible payment

・Therefore, losses are treated lightly and repeated

Losses are not easily recognized as “payments.”

So they grow.

So they grow.

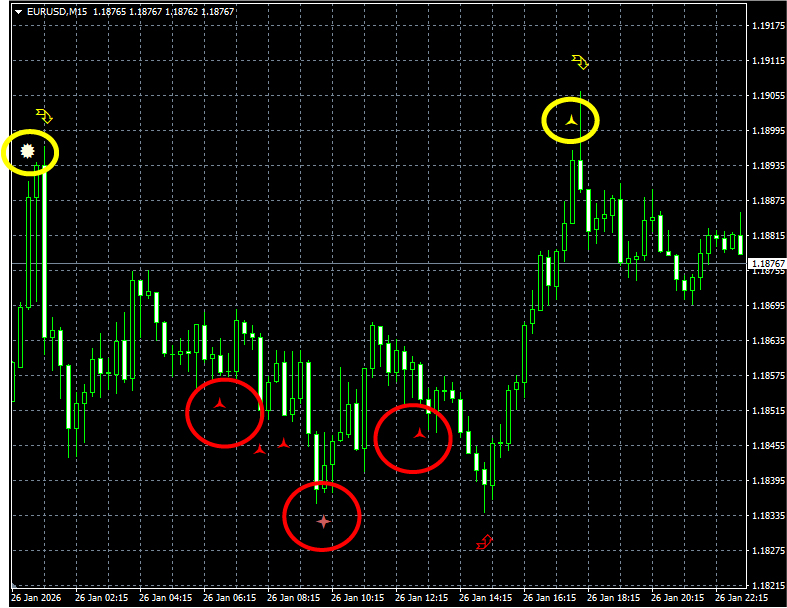

Looking at the numbers makes it obvious in an instant

Example: common losses

・Stop loss 20,000 yen × 5 times = 100,000 yen

・Stop loss 30,000 yen × 4 times = 120,000 yen

・Several “useless entries” can erase the tool cost

・Stop loss 30,000 yen × 4 times = 120,000 yen

・Several “useless entries” can erase the tool cost

What’s important here isthat nothing is left of that 100,000 yenafterward.

There is no guarantee your skills increase. No validation remains. No increase in reproducibility.

Only the fact that you “lost” piles up.

There is no guarantee your skills increase. No validation remains. No increase in reproducibility.

Only the fact that you “lost” piles up.

Losing 50,000 yen in the market happens in an instant.

Recovery is hell.

Recovery is hell.

The standard of “high vs. low” is off

Judging by price alone will make you repeat the same mistakes forever.

What you should look at is this.

Real decision criteria

・That iswhat it can stop

・That iswhat it can reduce

・That ishow reproducible it is

・That iswhat it can reduce

・That ishow reproducible it is

If you can stop the chain of losses with 50,000 yen, it’s too cheap

However, not every cheap tool is good

“Expensive = good” or “cheap = virtue” is not necessarily true.

What you should look at is,verificationandreproducibility.

Minimum checks

・Is there historical verification (backtesting)?

・Can it be reproduced without discretion (does everyone follow the same rules)?

・Are drawdowns disclosed (is there no hiding of how you lose)?

・Is there a philosophy of ongoing verification against market changes?

・Can it be reproduced without discretion (does everyone follow the same rules)?

・Are drawdowns disclosed (is there no hiding of how you lose)?

・Is there a philosophy of ongoing verification against market changes?

鬼速AI is designed to “stop losses”

鬼速AI premise

・Rules that can be reproduced without discretion (reducing hesitation)

・Based on historical verification (minimum condition)

・microAI automatically relearns thousands of conditions as the market changes

・The learning results arecontinuously re-validated automatically

・Verification performance that humans cannot reproduce (speed, frequency, continuity)

・Based on historical verification (minimum condition)

・microAI automatically relearns thousands of conditions as the market changes

・The learning results arecontinuously re-validated automatically

・Verification performance that humans cannot reproduce (speed, frequency, continuity)

50,000 yen is not a magic for winning.

It is a device to stop the system that keeps losing.

It is a device to stop the system that keeps losing.

Next, which is more expensive: the 50,000 yen you would lose in the market or the 50,000 yen you pay now?

Which is higher?

People who worry about 50,000 yen end up worrying in the market as well.

Which is higher?

People who worry about 50,000 yen end up worrying in the market as well.

※ There are risks in investing. Past performance does not guarantee future results.

× ![]()